Financial and Managerial Accounting: A Comprehensive Overview

Accounting is one of the crucial functions that is needed in the execution of daily operations of any business organization. It will enable an organization to understand its health status, make decisions, and, most importantly, follow all laws and regulations. There exist two principal types of accounting within organizations; that is, financial and managerial accounting. Although both share the same characteristics, the purposes, methods, and audience are different. In this article, we’ll be learning the difference between financial accounting and managerial accounting and how are financial and managerial accounting similar.

What is Financial Accounting?

Financial accounting is that specialized branch of accounting which deals with the financial transaction by recording, summarizing, and reporting. A major scope of financial accounting is preparing the financial statements like balance sheet, income statement, and cash flow statement that summarizes the overall position of the company and its performance during the time period.

All these financial statements are generally required by the external users of the organization, which include the following:

- Shareholders

- Investors

- Creditors

- Regulators

- Tax authorities

It strictly follows standardized principles under Generally Accepted Accounting Principles or International Financial Reporting Standards, based on a specific country. These ensure consistency and transparency and comparability between businesses for reporting their financials. Through the use of financial statements, one is able to evaluate its profitability, liquidity, solvency, and other relative measurements for financial health. For example, such reports help investors in coming up with decisions about whether to invest in a company or not, while creditors use the scope of capability of the company in repaying loans.

What is Managerial Accounting?

Managerial accounting handles internal needs of a firm. It is the process by which financial information is compiled, analyzed, and conclusions are drawn to enable better decisions by management. The objective of managerial accounting is to provide managers with exactly what and how much they require to guide the planning and control of operations and strategic decisions. On the other hand, managerial accounting does not follow standardized principles. It is more flexible since the information produced is to be used internally. Managerial accounting reports can be customized according to the needs of different departments and decision-makers within the same company.

Some common reports that are prepared in managerial accounting include:

- Budget reports

- Cost analysis

- Break-even analysis

- Performance evaluation reports

These reports help managers make a decision regarding pricing, production, resource allocation, and cost control and a whole lot more. For instance, cost analysis reports help the manager to determine the cost of making a product which determines the price strategy of that product.

Do you want to know more about our hihellohr Software?

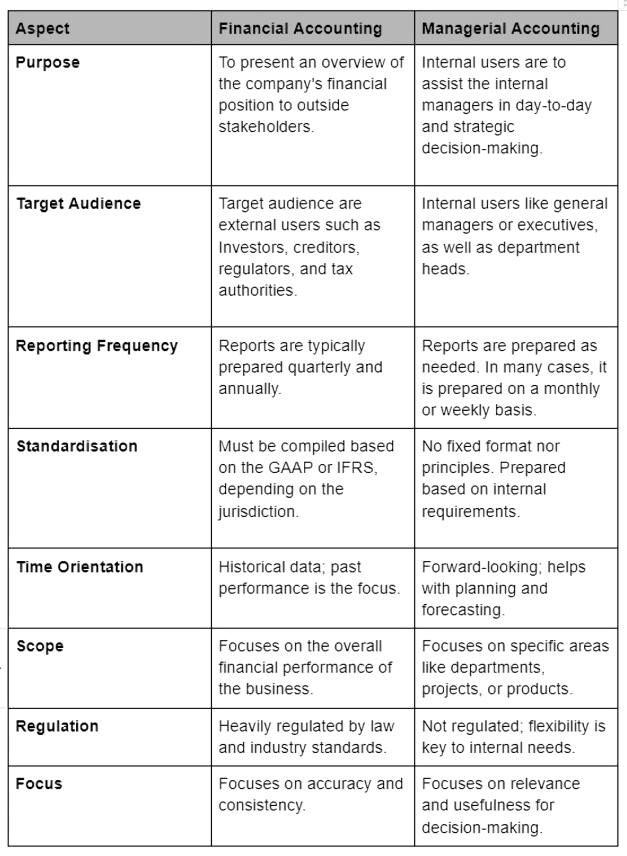

Key Differences Between

Financial and Managerial Accounting

While both financial and managerial accounting share some common properties but there are still some difference between financial accounting and managerial accounting, which we have discussed below in detail:

How are Financial and Managerial Accounting Similar

While financial and managerial accounting are different, they also possess many similarities as given below:

-

Both Engage with Financial Information

Both involve obtaining and analyzing financial information. Proper data and proper processing are required to ensure that the information acquired is helpful and reliable.

-

The Goal of Decision-Making

Whether providing the external stakeholders with a clear picture of performance or offering internal managers all the necessary data to make proper decisions, both types of accounting are closely associated with guides to decision-making.

-

Use of Accounting Principles

Both accounts are based on basic accounting principles, for instance, the double-entry system, which credits each transaction to balance itself in terms of financial transactions. The principles behind such calculations, as in debits and credits, are the same for both.

-

Focus on Costs and Revenue

These two types of accounting concern cost revenue analysis. Financial accounting gives an overview of costs and revenues that affect the general financial well-being of companies, whereas managerial accounting zooms in on specific operational costs and revenues.

-

Recording the transactions

The financial as well as managerial types of accountants should note that they record the financial activities within the organization. Their steps in recording the financial transactions are somewhat the same; it is the data used that distinguishes the two accountants.

Conclusion

Although financial accounting and managerial accounting serve different purposes and fulfil different needs, both are required components of a company’s accounting system. financial and managerial accounting the basis for business decisions, which highlights how financial accounting produces standardized periodic reporting of the overall health of a company from the viewpoint of external users of accounting information. Managerial accounting, on the other hand, is very flexible and is able to give detailed insights, which support internal decision-making processes. So, understanding the differences and similarities between the two is very essential in knowing how companies are operated or in the need for facts in making a proper decision.

Related Articles: